Tear down your white picket fence and put the minivan up for sale; the new American Dream is all about being a DINK—Double Income No Kids. Here’s why.

Table of Contents

It’s Too Expensive to Be Single

Sure, being single is better than it once was. The social stigma around it is changing, there’s a new narrative around singledom as a form of empowerment, and entire media streams are devoted to teaching individuals how to embrace “solo” life. But being single still—perhaps even more than ever—is a huge financial burden in many ways.

Just to name a few, single people are financially disadvantaged when it comes to:

- Paying rent

- Buying a home or car

- Social Security benefits

- Insurance benefits

- Travel costs

- Paying utility bills

- Affording basic necessities

One of the main areas where singles are getting the short end of the stick is buying groceries. Grocery prices rose 13.1% between September 2021 and September 2022. 1 That’s before the startling jump in egg and dairy prices in the final months of 2022, which saw egg prices rise 49.1% and the cost of butter shoot up 27%. 2

A TikTok creator posted a video about it being cheaper to buy meals out than to cook at home. 3

@ange_carini I’m going to be that mom that says, “back when I was young movie tickets where only $7” 🫠🫠🫠 #expensivegroceries #fyp #whyiseverythingsoexpensive #costofgroceries #cava #groceryshopping #groceries #inflation ♬ original sound – Angela Carini

It quickly racked up over a million views, and the comments section went off with people emphatically agreeing or refuting the claim. A lot of the debate revolved around groceries only being cost-effective if you buy in bulk. But with only yourself to cook for, buying in bulk is usually a waste.

With the so-called “single tax” only getting more expensive, being in a partnership provides a serious financial boost.

Having Kids Costs More Than Just Money

Marriage and committed partnership were once only part of The Dream, a necessary preface to starting a family with children. But now, families of two are looking more and more appealing, cutting kids out of the equation.

The U.S. Agriculture Department estimates that raising a kid costs $17,000 per year. 4 Given the current rate of inflation, we can expect that number to grow substantially over the next decade.

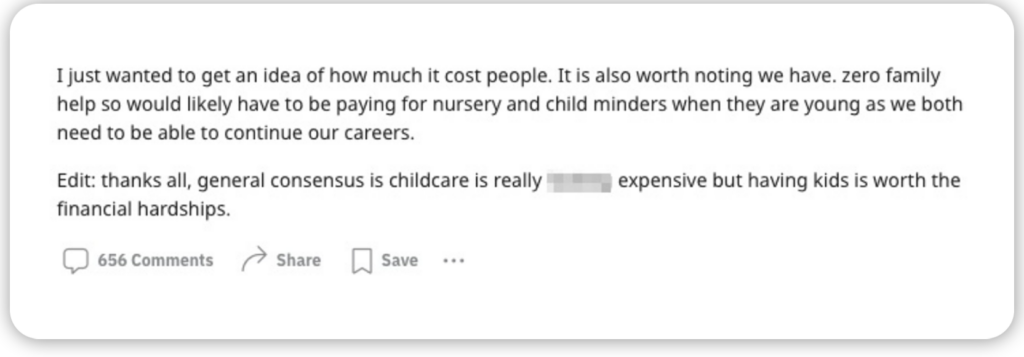

When a Reddit user posted a question about the real cost of kids, they received over 600 replies breaking down the known and unexpected expenses of child-rearing. They edited their original post to acknowledge the crowd sentiment that raising kids is astronomically expensive, but “worth the financial hardship.”

But for many, having kids is more than a question of affordability. When BuzzFeed surveyed people about why they chose not to have kids (or regret having ones they did), some of the reasons cited were:

- Stress and emotional toll

- Passing down disorders, disabilities, and trauma

- Loss of freedom

- Kids are messy and destructive

- Personal sacrifice

- Pregnancy and childbirth

- Lack of adequate support systems 5

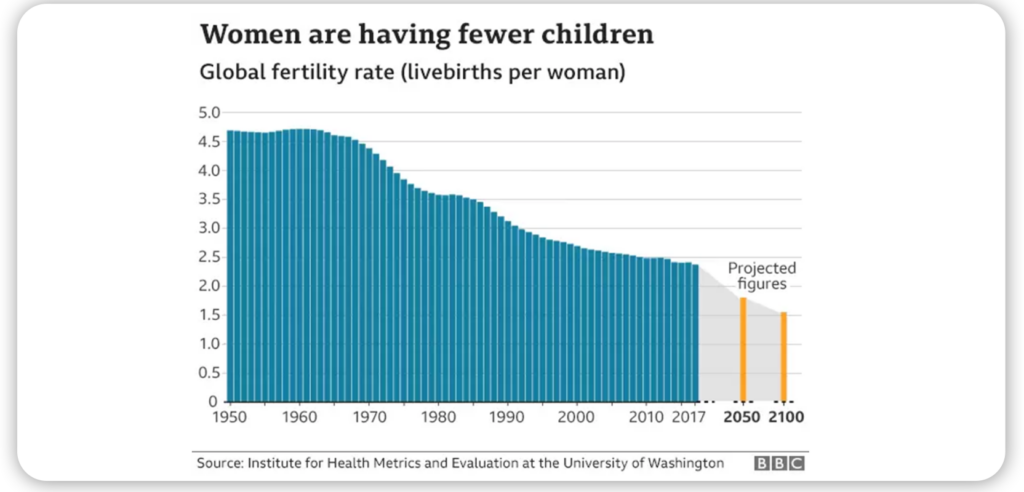

Kids don’t come cheap. With these other factors at play, there’s a lot to consider before committing to footing the bill for expanding the family. And more and more people are deciding against it; in fact, statistics show birth rates are historically low and projected to continue falling. 6

Upon weighing the many costs, many young Americans are bucking tradition and starting families that don’t involve children.

We Want to Enjoy Our Time…

While older generations put a lot of weight on having kids, younger people are placing more value on experiences. YOLO (You Only Live Once) became a popular refrain among millennials, acting as a slogan for a culture focused on embracing all life has to offer.

We interviewed Conrad Benz, a DINK who lives with his girlfriend of 8 years and considers this his ideal family structure. Of his and his partner’s choice not to have kids, he says:

“While we don’t often think about it, not having children affords us a lot of flexibility in how we live our lives. That’s probably the biggest factor. My girlfriend and I both moved abroad in our 20s, and are considering moving internationally again in the future. While moving to a different country is never easy, having no children makes the process much, much simpler.”

He goes on to emphasize the affordability of this lifestyle:

“Despite both making fairly modest incomes, we’re also able to travel multiple times per year and regularly take weekend trips to different cities or to go camping. Not having children gives us the resources and flexibility to plan things last minute and figure out logistics as we go. Really the only thing we have to think about is whether we can find someone to check in on our cats while we’re away.”

This kind of lifestyle is all the more affordable when you have a partner to share it with. For example, hotels, Airbnbs, and even cruise ship cabins cost as much for two people as for one (sometimes they even cost more for singles), effectively cutting the price in half for couples. Tack on bill-splitting for extras like food and transportation, and being a child-free twosome makes living a lavish lifestyle packed with travel and experiences a very real possibility.

… While It Lasts

If 20- and 30-somethings are all about embracing the experiences life has to offer, why not want to share that with little ones?

We’re all familiar with the sentiment that “the children are our future.” One of the most commonly cited reasons for having kids is to propagate the next generation. But millennials and Gen Z (the two largest cohorts of child-bearing age) are hesitant to add bodies to a world they believe is on its last leg.

Becky Meadows writes of the collective apathy of Gen Z as an:

“… ongoing nihilistic perspective about the world’s environmental and social landscape. This generation has lived with climate meltdown fears in the same manner that Boomers lived with nuclear bomb drills in school. They’ve seen more kids die in school than any generation before. They’ve seen movements like BLM and #MeToo fail to make substantial meaningful change. They’ve seen both the chaos and the lack of any meaningful resolution to the chaos.”

When you grow up watching pain, poverty, inequality, and melting ice caps flash across multiple screens at all hours of the day, it’s hard to maintain an optimistic vision of the future, much less bring children into that unknown future.

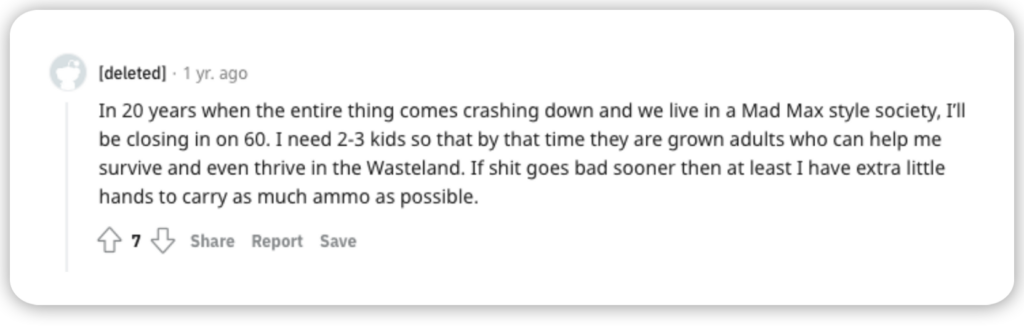

One Redditor offers up a tongue-in-cheek reason to have kids when the end days are nigh: 7

When young people think the apocalypse is around the corner, why would they want to invest their money in raising children with precarious outlooks rather than enjoying the time they have on this planet?

Hail to the DINK

Surrounded by crisis and staggering costs, the nuclear family is a dream of the past. The new fantasy—the ultimate embrace of fun, freedom, and financial sensibility—is DINK life. Arguably the only thing better than being a DINK is being a DINKWAD (Double Income No Kids with a Dog).