In 2021, credit card bills accounted for 19% of the debt in the US owned by individual consumers, making credit cards the second leading cause of debt. 1 When your credit card bills pile up, so do your interest charges, which means that getting out of debt can start to feel like an insurmountable task.

But clearing your credit card debt isn’t impossible—you can do it by using a few basic strategies. Learn the 7 best ways to pay off your credit card debt and put them into practice as soon as you can.

Table of Contents

1. Focus on paying one debt at a time

Facing a pile of credit card debt is overwhelming. Instead of tackling all of your debts at once, prioritize them and focus on one credit card bill at a time.

There are two ways to prioritize credit card debt:

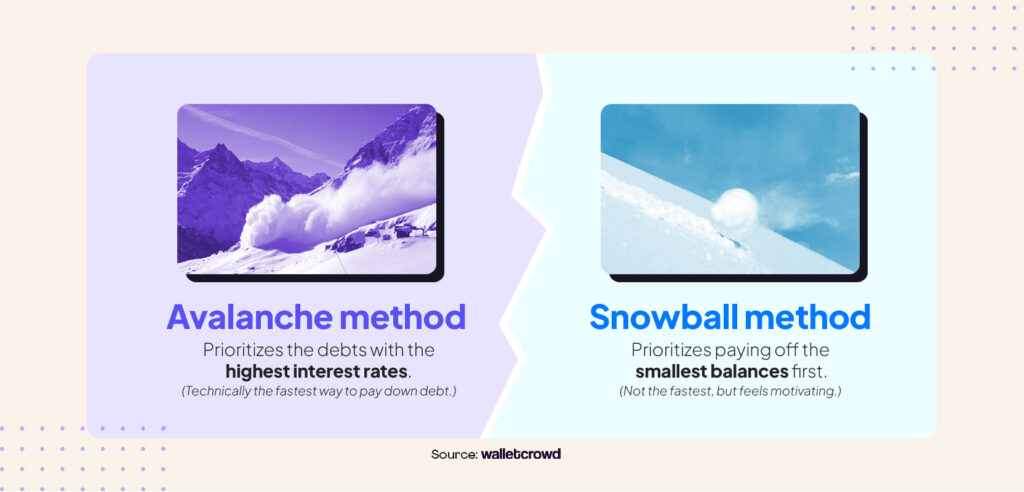

Avalanche method

The avalanche method is a debt repayment strategy that prioritizes the debts with the highest interest rates.

By using the avalanche method, you pay off the credit card bill that’s costing you the most money first. Again, note that this method targets the debt with the highest interest rate, not necessarily the one with the highest balance.

By paying off high-interest debts first, you’re saving yourself money in the long run, enabling you to pay off your debts more quickly and pay less overall.

If you have cards with equal APRs, pay down the smaller debt first. Paying off the bigger balance will take more time, which can be discouraging.

Snowball method

The snowball method is a debt repayment strategy that prioritizes paying off your smallest balances first.

This method helps you eliminate your debts more quickly than the avalanche method (at least in the beginning). This can be satisfying and can help keep you motivated.

However, this method will result in paying more money in the long run. We don’t recommend using the snowball method if your smaller balances have significantly lower interest rates than your larger debts.

However, if your credit cards have comparable APRs, targeting your lesser balances with the snowball method can be a good way of keeping your debt repayment efforts on track.

2. Pay more than your monthly minimum

When faced with any credit card debt, the most important thing is to at least make your minimum monthly payments. But to get out of debt fast, you need to pay more than that.

“If possible, I always recommend making more than the minimum payments on your credit card,” says Kendall Meade, CFP®. She notes that credit cards can have very high interest rates and that “if you are just making minimum payments, it can take a very long time to pay off this debt.”

To effectively use this strategy, follow these two steps:

- Consider your monthly budget: Decide how much money you need to put towards your living expenses and emergency funds, then determine how much you can afford to put towards your credit card bills.

- Set up autopay: Authorize an automatic payment for however much you can spare every month (e.g., $300). You can set up autopay through your credit card’s online management account or through your online banking platform.

Even if you only pay 10% above the minimum payment amount, your debt will dwindle faster and you’ll save money on interest. By setting this up through autopay, you probably won’t even notice the extra money coming out of your account each month.

3. Combine your debts

Debt consolidation is when you move debts across multiple credit cards onto a single credit card or loan.

According to Meade, “This can be helpful if you are able to get a lower interest rate, reducing the total amount you owe, allowing you to pay it off quicker.”

There are several common forms of debt consolidation you can use to get out of credit card debt, including:

Debt consolidation loan

A debt consolidation loan is a type of installment loan, like an auto loan or a mortgage. Here’s how it works:

- You apply for a debt consolidation loan at a bank or credit union or with a private lender.

- Once you qualify for the loan, you receive a lump sum of money.

- You use this money to pay off your credit card debts.

- You then pay back the debt consolidation loan over a fixed period of time (e.g., 18 months).

Debt consolidation loans often have lower interest rates than credit cards, which makes them appealing if you’re drowning in interest charges. Additionally, the fixed-rate repayment makes this type of loan easier to manage when compared to credit card bills (for which your monthly payments will fluctuate).

However, debt consolidation loans have downsides. They often come with fees, and opening the loan will trigger a credit check known as a hard inquiry, which will knock a few points off your credit score.

If you pick a loan with a long repayment term, it’s also possible your lender will raise your interest rate partway through. What’s more, if you have the loan for a while, you may end up paying off your debt over a longer period of time than you otherwise would have needed.

Balance transfer

A balance transfer is when you move debt from one credit card to another with a lower interest rate.

To perform a balance transfer, get a 0% APR credit card, then contact the card issuer and request a balance transfer. As long as your new credit card’s credit limit is high enough, you can transfer multiple cards’ worth of debt onto your new zero-interest card.

As with debt consolidation loans, balance transfers have some cons:

- You may have to pay balance transfer fees

- 0% APR cards are only available to good credit holders, so if your debt has already damaged your credit, you might not qualify

- Balance transfer cards often have high APRs after the introductory 0% APR period has expired

- Opening a new credit card will also damage your credit through a hard inquiry

- More credit may tempt you to spend more on your credit cards

Still, balance transfers can be a very effective method of condensing your debts and paying off your credit card balances quickly.

4. Reduce your spending

It’s a hard reality to come to terms with, but the truth is that to pay off your debts, you might have to reduce your monthly spending. Changing your lifestyle is rarely easy, but you may find it necessary to cut back (at least for a little while) in order to avoid being buried in credit card debt.

Figure out ways to reduce your spending and put the money you save towards your credit card bills.

While you certainly can save money by making big changes (e.g., moving homes), there are probably small changes you can make to save money month-to-month. For example:

- Cancel or pause your subscriptions, e.g., Netflix

- Get a library card instead of buying books

- Download a coupon-or-discount-finding app

- Cook more meals at home instead of going to restaurants or ordering in

- Walk, bike, or ride public transit at least one day a week

If each of these changes saves you just $10 per month, you’ll have $50 to add to every credit card payment.

5. Earn extra money

If you really want to make a quick dent in your credit card debt, increase your income at the same time that you reduce your spending, then use your extra funds to pay down your bills.

Of course, making money is easier said than done. However, if you’re willing to spend time doing extra work, there are plenty of options available today. You can:

- Freelance

- Deliver food

- Sell homemade goods

- Run errands

- Take surveys online

If working a side hustle doesn’t make sense for your situation, consider selling some of your old things on Craigslist, Facebook Marketplace, or eBay.

The key to making this tip work is to put that bonus cash towards your debts right away so that you aren’t tempted to spend it elsewhere instead.

6. Use cash instead of credit cards

When you’re trying to get out of credit card debt, make sure to not add to it.

Focus on using cash or debit cards to make everyday purchases instead of your credit cards. Not only does this make paying down your credit cards easier, but it can help you be more conscientious of your spending.

7. Set up a debt management plan

If you’re overwhelmed tackling your credit card debt on your own, you can get help from a credit counselor. Credit counselors are trained financial advisors that can help you:

- Assess your debt situation

- Come up with a budget

- Enroll in a debt management plan (where they’ll negotiate with your creditors to get better repayment terms)

Basically, a credit counselor can help you figure out the best way of paying off your credit card debt.

Of course, it’s important to make sure whatever debt counseling agency you hire is legitimate. Start your credit counseling search with the Financial Counseling Association of America or the National Foundation for Credit Counseling.