The 15/3 credit hack is a method of paying your credit card bills that supposedly will improve your credit score. To find out whether this hack actually works and how you can put it into action, read our guide below.

Table of Contents

What is the 15/3 credit card payment hack?

The 15/3 credit card payment hack is a system of paying your credit card bill at certain times each month to optimize your credit score.

Essentially, the idea is that you pay your credit card bill:

- 15 days before your statement closing date

- 3 days before your statement closing date

- An optional third time between the statement closing date and the statement due date

Does the 15/3 credit hack actually work?

While this is among the most popular credit hacks, the truth is, there’s nothing magical about the 15/3 trick. It isn’t really a “hack”; at its core, it’s just a framework for paying your bills in full and on time.

As long as you’re on top of your credit card bills, it doesn’t matter what specific dates you pay them on. Your payment dates, the number of payments you make, and the amounts you pay can (and should!) be customized to fit your unique financial situation.

How does the 15/3 rule work?

We’ll dive into how exactly the 15/3 payment trick works in this section, but let’s first define some key terms:

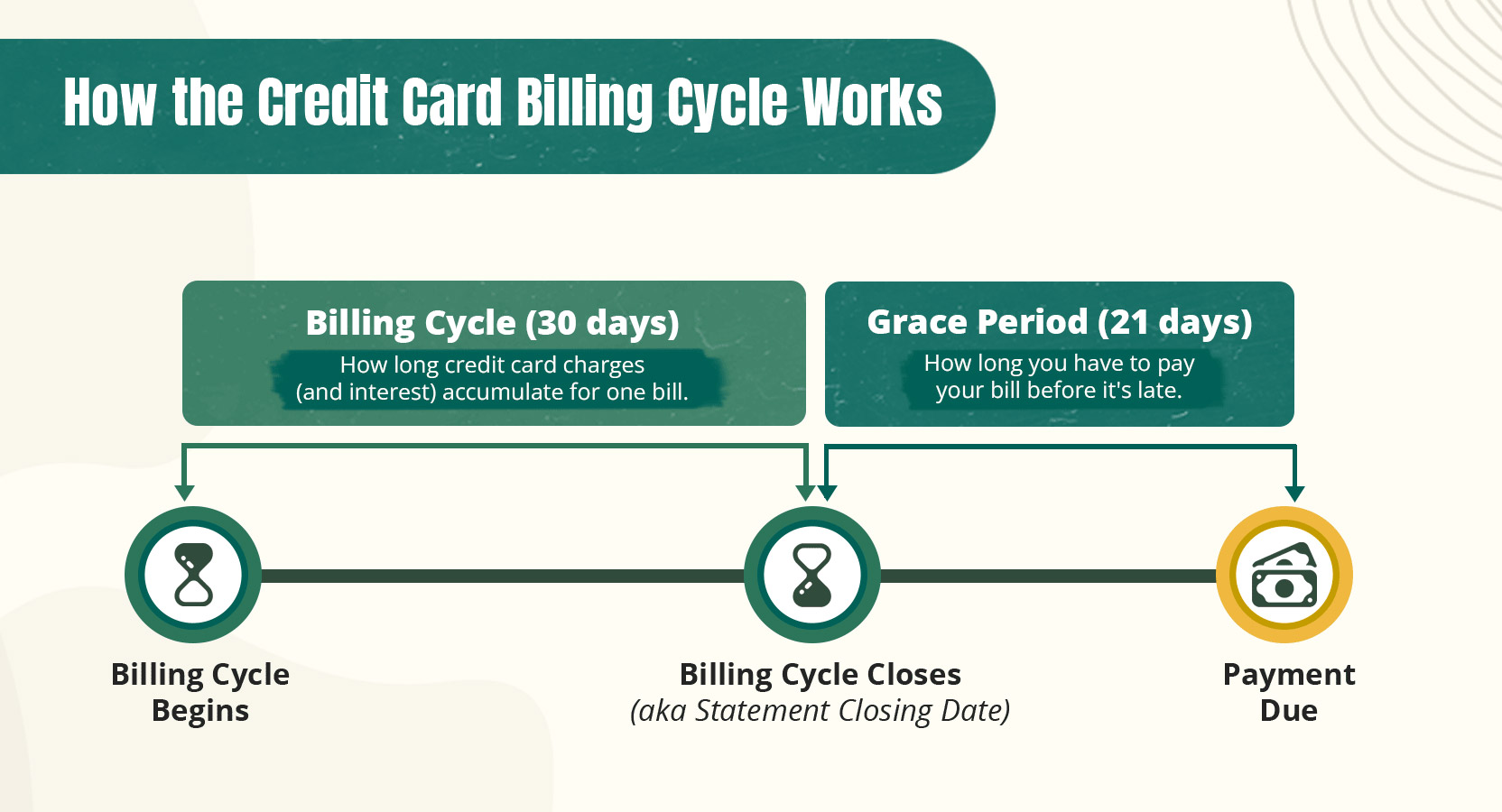

- Statement closing date: Your statement closing date is the last day of your billing cycle. On this day, your lender will tally up your charges for that cycle. This date will be unique to your card, so you’ll need to look it up online or on your monthly bill to know when your statement closing date is.

- Due date: The due date is the day by which you must pay your balance in full to avoid incurring interest charges, or at least make your minimum payment to avoid late fees. By law, your due date must be at least 21 days after your statement closing date. Once again, you can find this date by checking your bill or card information.

- Credit reporting: Credit reporting is when your lender reports your credit activity to one or more of the three major credit bureaus (Equifax, Experian, and TransUnion). Credit reporting is optional for lenders, but helps borrowers build credit, as the information reported is used to update your credit score. Many lenders report your credit activity on your card’s statement closing date.

To help you visualize the dates mentioned above, here’s an illustration of a credit card billing cycle:

Illustrating your credit card billing cycle

Explaining the 15/3 credit hack with an example

To understand how the 15/3 rule works, let’s look at it in action. Here’s an example of how Jane uses the 15/3 rule to pay her credit card bill.

- Jane’s billing cycle: March 15–April 15

- Statement closing date: April 15

- Due date: May 6

- Current credit card balance: $1,000

Jane is trying to build her credit, so she’s looked up her card’s important dates and is ready to use the 15/3 hack to her advantage. She follows these steps:

- March 15: Jane makes a payment of $500 (15 days before her statement closing date).

- April 12: Jane makes another payment of $500 (3 days before her statement closing date).

- April 14: Jane makes a $100 purchase. She now only has a balance of $100 on her statement closing date (the 15th).

- April 19: Jane pays her $100 remaining balance on April 19, which means her past balance is fully paid off by the due date.

We know that Jane avoided interest charges and penalty fees by paying her credit card in full by the due date (May 6), but why make an effort to pay before the statement closing date?

In other words, why not just pay all $1,100 on April 19 (or whatever day that Jane is ready to make a payment, as long as it’s before May 6)?

To answer that, let’s explore what the 15/3 hack actually accomplishes and how it can impact your credit score.

Why does the 15/3 credit card hack work?

To the extent that the 15/3 credit card hack actually works, it does so by targeting two of the most important factors that affect your credit score:

- Payment history

- Credit utilization rate

The 15/3 hack encourages good habits that benefit both of these scoring factors.

How the 15/3 hack impacts your payment history

Your payment history is the most important factor in both your FICO and VantageScore credit scores, accounting for 35%–41% of your total score.

Maintaining a good payment history means making on-time payments on outstanding loans and credit accounts (including credit cards).

The 15/3 hack isn’t necessary to do this, but it makes it easier. By paying your bill well before the due date, you won’t risk accidentally missing a payment (or having one fail to go through at the last minute), which could hurt your credit score. Furthermore, paying in smaller chunks makes it easier to track your finances and ensure you always have the funds to pay your bills on time.

How the 15/3 hack affects your credit utilization rate

The other major credit score factor that the 15/3 hack targets is your credit utilization rate.

Your credit utilization rate is the amount of credit that you’re using relative to your available credit. It determines 20%–30% of your credit score, making it the second most important scoring factor after your payment history.

It’s calculated by dividing your outstanding balance across all your credit cards by your total credit limit (also across all your cards). For instance, if your cards have a combined limit of $1,000 and your current balances total $250, your credit utilization is 25%.

A lower credit utilization rate is better for your credit score. Experts suggest that keeping it under 10% is ideal; if you can’t manage that, you should at least keep it under 30%.

Using the 15/3 hack to keep your utilization rate low

According to Kendall Meade, CFP®, the 15/3 hack “can help raise your credit score in the short term by lowering your credit utilization.” This is because paying your balance frequently (which the 15/3 hack requires) keeps it from growing too large at any given time. If you make 2–3 payments per month, your balance (and consequently your credit utilization) will never be able to get as high as if you just made one large payment.

Moreover, there’s a good chance your lender will report your balance on or just after your statement closing date (it’s up to them when they report it, but that schedule is common). The 15/3 hack involves making a full payment just before your closing date—in other words, right before your balance gets reported.

In short, the 15/3 hack makes it more likely that your credit card issuer will report a low (potentially 0%) credit utilization rate to the credit bureaus that create your credit report, which will benefit your score.

What are the limitations of the 15/3 credit hack?

As you’ve seen, the 15/3 credit hack can help you stay on top of your bills. However, there’s nothing magical about paying on the dates it specifies.

This “hack” would be just as effective if you shifted your payment dates one day closer to your closing date (which would effectively turn it into a “14/2 hack”), or if you elected to make even more frequent payments than the hack requires, or if you changed it in another way entirely—as long as your chosen method still involved paying in full by your due date.

At its core, the 15/3 hack is just a catchy rule to help you remember to pay your bill frequently (and to always pay on time). If it helps you remember to do that, it has real value. Just don’t be fooled by the word “hack” into thinking it will provide a special boost to your credit score beyond that.

Should you use the 15/3 credit card payment hack?

The 15/3 credit card payment hack can be worth using if it will help you to stay on top of your bills.

However, as mentioned, the 15/3 hack is just a guideline. Meade cautions against overthinking—”If your goal is long-term financial health, you are best off focusing on the basics.” For her, this means paying off your credit card in full by the due date so that you avoid paying interest.

It isn’t necessary to fixate on any particular payment schedule. Ultimately, as long as you’re paying off your credit cards on time each month, you’re doing what you need to maintain a healthy credit score.